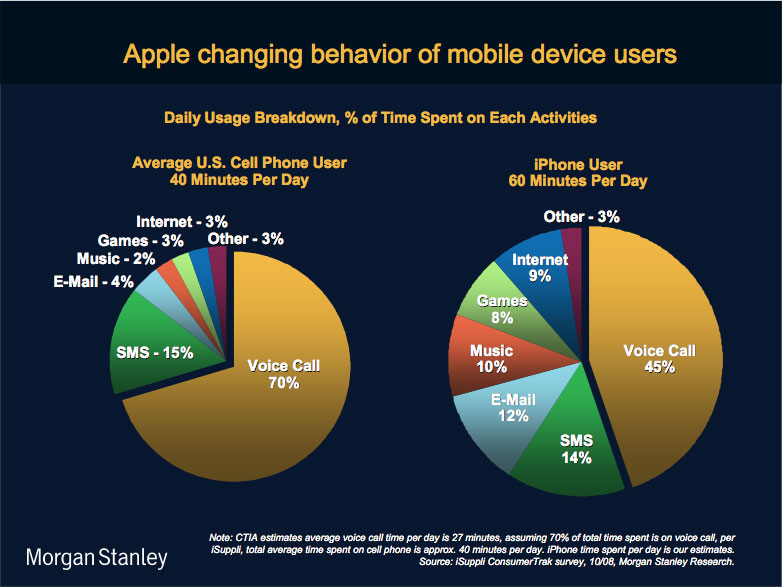

Flip-flopping Morgan Stanley analyst Kathryn Huberty recently raised her price target for Apple Stock to $180, up from a previous target of $100. Huberty noted that the “iPhone is leading earnings growth that the market is missing”, while also “emerging as the clear leader in the battle over the mobile internet.”

The core of our stock call is that the iPhone’s success and higher margins will begin to mute the fundamental margin and growth risks in Apple’s core Mac/iPod businesses…

Morgan Stanley believes that the iPhone will be the source of 50% of the company’s earnings in 2010, up from 30% in 2008. We expect a price cut to the current generation iPhone to drive 50 percent to 100 percent (2 million to 4 million units) incremental unit demand…

The upgrade from Morgan Stanley is a bit surprising, not because of the analysis, but because of the source.

Kathryn Huberty isn’t the most popular analyst amongst Apple fans. She’s generally bearish on Apple, and as some mac fans will be quick to point out, many of her past predictions have been glaringly off-base. As of April, Huberty had a $95 price target for Apple that she subsequently raised to $100. At the time, Apple was trading in the high 120’s. What a difference a month makes.

Tue, May 26, 2009

Finance, News