Having learned the pitfalls of exorbitantly high product pricing , Apple shocked everybody when they released the original iPad for only $499. While that now seems to be the going rate for any base model tablet these days, remember that in the weeks preceding the iPad launch, many were anticipating Apple’s tablet to fall in the $800-$1000 range.

With the iPad still the market leader, competitors have been working furiously to develop tablets that can give the iPad a run for its money. But unlike the smartphone market where subsidies enable companies to practically give their devices away for free, tablet manufacturers are having a tremendously hard time competing with Apple on price.

Because Apple controls both the hardware and the software, it’s able to streamline the manufacturing process to create top of the line hardware and optimize its software accordingly.

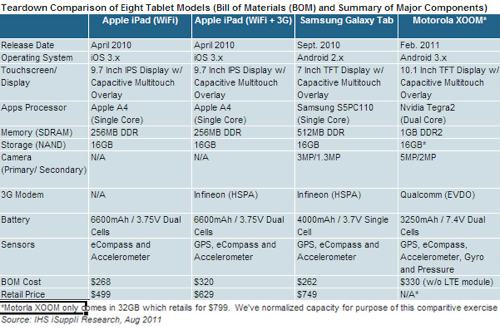

Highlighting an iSuppli teardown study comparing the iPad and top competing tablets such as the Motorola Xoom and the Samsung Galaxy tablet, Electronista writes that Apple enjoys design efficiencies that other companies simply can’t match.

For example, because Apple also controls the operating system used in the iPad and also designed the processor, it can achieve performance as good or better than competitors with half the RAM found on non-Apple tablets, saving the company $14 per unit in basic material costs. Apple’s ability to know in advance every component that will go into iPad hardware allows them to customize and leverage hardware to maximize performance, as well as significantly reduce costs — a factor that allowed Apple to set the bar for tablet pricing at $499, which in turn has cost competitors dearly in terms of quick profitability.

Apple’s vertical integration model also results in a more aesthetically pleasing and functional device. Take battery for example. Whereas Apple can start off with its optimal design and work backwards from there, the hardware design choices chosen by competitors are often dictated by external factors they have no control over. As a result, non-Apple tablets tend to be thicker and more squarish as competitors look to match the iPads incredible battery life.

Apple’s tablet success is rooted in optimization and design efficiencies that competitors can’t keep up with. Consequently, the iPad is going up against tablets that don’t look as good as the iPad, are more expensive than the iPad, and don’t work as well as the iPad.

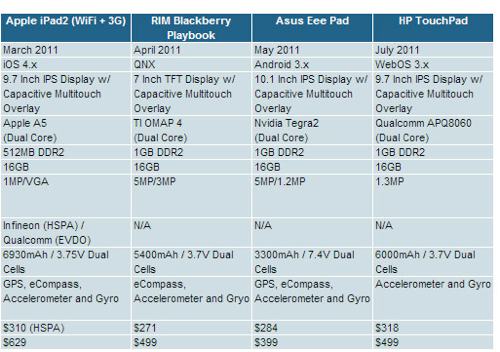

To account for the inherent cost associated with manufacturing tablets, some companies like RIM and Samsung have released smaller form factor tablets in an effort to save money. But as Steve Jobs predicted, these sub 9.7-inch tablets have been dead on arrival and have failed to gain any traction in the market.

Further highlighting Apple’s design efficiency, the bill of materials on these smaller tablets is about the same as the cost of materials used for the larger iPad.

Because of the smaller size of their offerings, RIM and Samsung’s seven-inch models both rated lower “bill of materials” (raw component, or BOM) costs than any model of iPad. The seven-inch Playbook had a BOM cost of $271 with a retail price of $499, while the Galaxy Tab had a BOM cost of $262 with an original retail price of $749 (off contract). The original iPad had a BOM cost of $268.

And just to drive the point home, some charts encapsulating all of iSuppli’s data.

Mon, Aug 8, 2011

Finance, News