A few weeks ago, Apple delivered blowout earnings that completely demolished Wall Street’s expectations. For the June quarter, Apple posted revenue of $28.57 billion, setting a new all-time quarterly record.

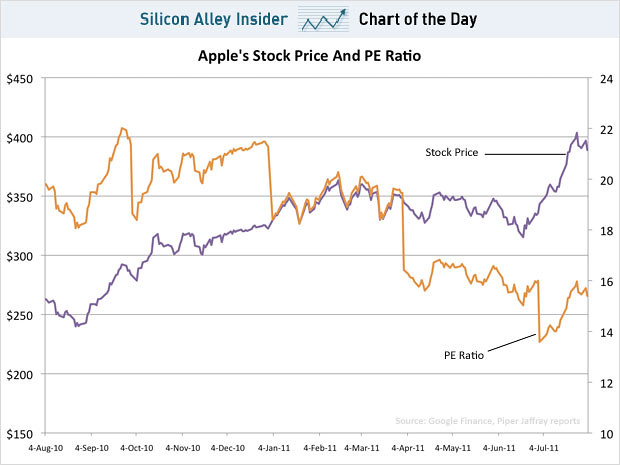

Following Apple’s stellar earnings report, Apple shares began to aggressively climb upward where they would eventually top the $400/share barrier and reach an all-time intraday high of $404.50 a share.

Apple shares have since dipped a bit, highlighted by today’s 10+ point drop in the wake of the Dow falling over 300 points. Though Apple is currently trading in the $380 range, we can confidently predict that Apple shares will inevitably climb back up to $400.

That notwithstanding, Apple’s share price relative to its P/E remains incomprehensibly low. When Apple shares hit $400, its P/E was about 15.96.

To put that figure into context, let’s look at some other companies.

Apple not only makes more money than Amazon, but is also growing its bottom line at a much faster rate. Still, curiously, Amazon’s P/E ratio is 6 times higher than Apples (89.50 last we checked). Even Netflix has a P/E that’s nearly 4 times as high as Apples (62.58).

And here’s the kicker – whereas Apple experienced 82% quarterly growth year over year, Amazon and Netflix recorded 51 and 48% growth respectively measured over the same time period.

We’d like to think that Wall St. will soon come around and value Apple appropriately but the honest truth is that they’ve been underestimating and undervaluing Apple for years. It’s almost unprecedented that a company as big as Apple can continue to grow its earnings at over 80%. And the scary thing is that it does so on a consistent basis.

In any event, Business Insider put together this illustrative chart which depicts how undervalued Apple shares are. As Apple’s share price has increased over the past few months, it’s P/E ratio has correspondingly dipped. The take away is that Apple’s earnings are growing at a much faster clip than what is reflected in its share price. The bottom line is that Apple, even at price levels bordering $400 a share, remains grossly undervalued.

via Business Insider

Thu, Aug 4, 2011

Finance, News