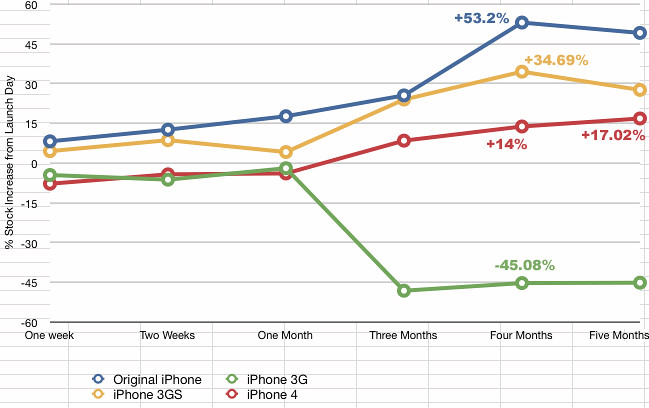

With the iPhone 4S set for release on October 14, we looked back at previous iPhone launches and compiled a chart tracking Apple’s stock performance in the weeks and months after launch day.

As the chart below indicates, Apple’s stock price four months after launch day tends to yield the best return on investment. The lone exception is the iPhone 4 which saw a slight bump five months out compared to four months.

For investors looking to sell on the news, Apple’s share price usually dips in the period following a new iPhone announcement and the week preceding the corresponding launch date. While this is usually a slight dip, the iPhone 4S announcement resulted in a particularly steep fall as shares tumbled to $362 last Wednesday morning before rebounding over the past few days to +$390 levels.

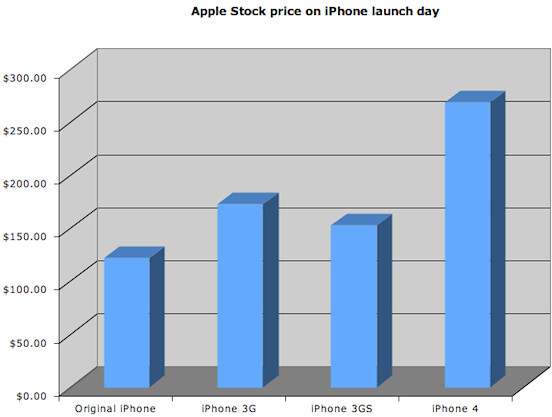

Overall, Apple shares have been on an unprecedented roll over the past few weeks, hitting an all-time high of $422 just a few weeks ago. Since then, shares have leveled off a bit. Still, if we take a look at Apple’s overall share price on launch day of a new iPhone, we see an upward trend – with the iPhone 3GS serving as an aberrational data point. At the time of this writing, shares of Apple are trading at $396.68 after having climbed over 20 points in just two days.

Tue, Oct 11, 2011

Finance, News